Press Release

Rolf Meieru – Chief Investment Officer (CIO)

Rolf Meieru is a Chief Investment Officer (CIO) at Horizon Venture Fund, with over ten years of experience in the global financial markets. He specializes in high-frequency trading (HFT), statistical arbitrage (Stat Arb), market-neutral strategies, and volatility trading, employing sophisticated trading models and AI-driven strategies. His expertise in institutional investment management and ETF fund management has delivered outstanding performance.

2020-2024: AI-Driven Complex Arbitrage Trading System

Between 2020 and 2024, Rolf Meieru successfully integrated artificial intelligence (AI) with quantitative trading algorithms, developing an advanced institutional-grade arbitrage trading system that maintained stable returns even under extreme market conditions. The core elements of this system include:

High-Frequency Trading (HFT) – Utilizing ultra-low-latency execution to optimize order placement and capture market microstructure arbitrage opportunities.

Statistical Arbitrage (Stat Arb) – AI and machine learning-based models identifying historical correlations and mean-reversion patterns for profitable trading.

Market-Neutral Strategy – Implementing hedging and market-neutral techniques to ensure consistent returns across different market environments.

Volatility Trading – Utilizing VIX index and option strategies to construct high-yield portfolios during market turbulence.

During the 2022-2023 period of significant global market volatility, Rolf Meieru trading team successfully leveraged AI-driven anomaly detection and automated trading strategies, outperforming major indices for four consecutive years and achieving a 42% compound annual return (CAGR) in the institutional hedge fund sector.

Outstanding Performance of the Horizon Venture Fund

Currently, the Horizon Venture Fund, led by Rolf Meieru, is achieving exceptional performance in the global markets. The fund’s superior returns are driven by:

AI-Enhanced Trading Strategies – Leveraging AI for market trend forecasting, improving trading precision, and optimizing ETF asset allocation.

Dynamic Cross-Asset Hedging – Diversified allocation across equities, fixed income, forex, and commodities, generating low-correlation returns.

Quantitative Trading & Active Management – Adjusting ETF weightings actively, capturing upside gains while maintaining stability during downturns.

Deep Market Exploration – Utilizing big data analysis to identify high-growth markets and sectors, securing consistent alpha returns.

Volatility Arbitrage & Event-Driven Strategies – Adapting to market events, central bank policies, and geopolitical shifts to optimize trading strategies.

In H1 2024, Rolf Meieru ETF trading team achieved over 30% returns, making Horizon Venture Fund a standout performer among global institutional investors.

Future Strategic Directions

In 2025, Rolf Meieru plans to further innovate AI-driven quantitative trading models, reinforcing Horizon Venture Fund expansion into global markets, blockchain finance, emerging market ETFs, and macro hedge funds. Additionally, he will focus on optimizing algorithmic trading strategies, deep liquidity management, and structured derivatives investments, ensuring that Horizon Venture Fund remains a leading institutional-grade trading fund.

“The market is constantly evolving. We must remain at the forefront, leveraging technology and data to build a dynamic investment system that adapts to market shifts.” — Rolf Meieru

As a Client Portfolio Specialist at Horizon Venture Fund, Rolf Meieru demonstrates exceptional expertise in high-frequency trading, quantitative arbitrage, market-neutral strategies, and volatility trading. His success in integrating AI with complex arbitrage trading systems has resulted in exceptional returns, positioning Horizon Venture Fund as a top-tier investment product in the global market.

His investment philosophy and cutting-edge trading methodologies continue to drive market innovation, setting new benchmarks in financial technology and institutional trading strategies.

Media Contact:

Official website: https://www.horizon.mn

Email: investments@horizoncapital.info

Contact person: Rolf Meieru

Address: Harbor Financial Tower 350 Madison Avenue, 24th Floor New York, NY 10017 USA

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

World AI Show Wraps Up Landmark Indonesia Edition, Announces 46th Global Edition in Kuala Lumpur, Malaysia

World AI Show Indonesia concludes with high-level dialogues, government and industry engagement on artificial intelligence innovation as Trescon names Kuala Lumpur the next stop for its global AI series following Indonesia’s successful showcase.

Jakarta, Indonesia, 11th July 2025, ZEX PR WIRE, The highly anticipated Indonesia edition of World AI Show concluded on 9th July at the JW Marriott, Jakarta. Over 1500 enterprise tech decision-makers, investors, innovators, policy makers, and AI innovators gathered from across Southeast Asia to explore the transformative power of Artificial Intelligence. Organised by Trescon, the event showcased Indonesia’s emergence as a major hub for AI innovation, in line with the nation’s Vision 2045 and its commitment to digital transformation.

The event was proudly supported by KORIKA, the Ministry of Industry – Indonesia, KADIN Jakarta, EC-Council, and other esteemed industry bodies like BRITCHAM Indonesia, Starfindo and Kumpul, the event highlighted the collective effort to advance AI adoption. These partnerships underscored the importance of public–private collaboration in fostering AI ecosystems in Indonesia and beyond.

The show featured 20+ top-tier sponsors, including Alibaba Cloud & BLUE POWER TECHNOLOGY, Tencent Cloud, UCLOUD GLOBAL, ASIX, Indonet, Reporty, Tech Proxima, ID star and many more. Their contributions created an immersive experience, facilitating high-value business connections and showcasing cutting-edge AI solutions shaping the region’s technological future.

The first day of the summit featured influential keynote addresses, thought leadership panels, and expert discussions on AI’s impact across industries. A standout moment came from a panel led by Prof. Hammam Riza, President of KORIKA and Vincent Henry Iswara, CEO of DANA Indonesia. Their session explored how AI aligns with Indonesia’s Vision 2045, offering a roadmap for using AI as a catalyst for socio-economic growth, digital inclusion, and innovation-driven transformation.

Other impactful conversations focused on AI ethics, workforce transformation, and cybersecurity, as leaders discussed how to harness AI’s potential responsibly.

Speaking on the occasion, Prof. Hammam Riza remarked, “Every time the World AI Show has been hosted in Indonesia, KORIKA has proudly been a part of it for the past three editions. Trescon has been instrumental in nurturing our AI ecosystem through the World AI Show, and we are very fortunate to continue this partnership. I am happy to see our journey with Trescon continuing to grow, as we work together to bring industry stakeholders—from businesses and technology leaders to civil society and the media—into meaningful dialogue and action that drives AI innovation and adoption across Indonesia.”

The event facilitated meaningful interactions, fostering new partnerships, investment opportunities, and cross-sector alliances that accelerated Indonesia’s digital transformation agenda. Echoing this sentiment, Abdulbadea Altukroni, CEO of Reporty, expressed his views, stating, “All the attendees were highly targeted, relevant, and actively engaged in the AI industry. This led to fruitful engagements with key stakeholders, policymakers, and leaders in the AI ecosystem. The event proved instrumental in helping us advance our company goals while also providing a valuable platform to witness the latest advancements in the market”

Day 2 of the event opened with keynote remarks from Arif Ilham Adnan, Co-Chairman/Permanent Committee at Association of Digital Leader Indonesia & The Jakarta Chamber of Commerce and Industry (KADIN Jakarta), who highlighted the importance of digital leadership, trust, and talent in advancing AI transformation. The day’s sessions focused on practical AI applications, industry innovation, and collaboration, with discussions that offered actionable insights and showcased real-world use cases.

The session on AI, 5G & Cloud explored how intelligent systems are powering smart cities, urban innovation, and next-gen infrastructure, featuring insights from leaders at Transjakarta, Sinar Mas Land, and PT. Asian Bulk Logistics. The AI & Cybersecurity panel helmed by Felix Jingga, Chief Technology Officer at Govtech Indonesia, Sankata Lee, VP IT Strategic, Architecture & Innovation Head at Bank Negara Indonesia, Dito Eka Cahya, Ph.D, Head of AIoT & Robotics Lab at BRIN and Co-Founder at Forumsatria.ai, and Aman Kumar, Senior Director at EC Council Global Services ,Tom West, Chairman at BritCham Technology & Digitalisation Hub and Director of Juicebox addressed the critical balance between innovation and resilience in a hyper-connected world.

Ms. Wina Fidelis Ulita, Senior Business Manager at Tencent Cloud shared, “We were delighted to participate in the World AI Show. This was a much-needed and unique platform for Indonesia, where I had the opportunity to meet numerous potential clients and partners equally passionate about driving AI-led innovation.”

One of the most anticipated moments was the FutureTech World Cup Indonesia Regionals, where emerging startups showcased ground-breaking solutions in AI, automation, and deep tech. Momofin was crowned the regional winner and will represent Indonesia in the Grand Finale at the Dubai AI Festival taking place in April 2026 in Dubai.

The event concluded on a high note, reinforcing Indonesia’s position as a growing centre for AI leadership and innovation, while providing a valuable platform for strategic networking and knowledge exchange.

As the event came to a close, Trescon announced the next chapter of its global AI series: the 46th Global Edition of the World AI Show, scheduled to take place in Kuala Lumpur, Malaysia, in October 2025. The upcoming edition is positioned to continue the conversation on AI’s pivotal role in driving economic diversification, fostering innovation, and enabling impact-driven transformation across the region. Register for the event at: https://worldaishow.com/malaysia

World AI Show Indonesia solidified Trescon’s mission to empower governments, enterprises, and innovators to harness AI for sustainable and inclusive growth, driving the future of AI across Southeast Asia and beyond.

For sponsorship opportunities at the upcoming World AI Show in Malaysia, please contact Shrikanth Prabhu, Commercial Director, at prabhu@tresconglobal.com or call +91 86601 15892.

About Trescon

Trescon is a global business events and consulting firm specialized in producing highly focused B2B events that connect businesses with opportunities through conferences, expos, investor connect and consulting services. For more information, visit: www.tresconglobal.com

Media Contact

Oyindrila Ghosh

Marketing Director – Asia Pacific

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bitcoin Tops $112,000 as Dormant Whales Resurface; $150,000 Target Seen Viable by Year End

Bitcoin surged to an all-time high above $112,000 this week, buoyed by a wave of reawakened whale wallets and increasing institutional flows. The renewed on-chain activity is reviving bullish sentiment, and some forecasts suggest BTC could hit $150,000 by year-end.

The world’s largest cryptocurrency climbed more than 18% since the start of 2025, pushing its market capitalization to $2.21 trillion. As of mid-July, BTC was trading near $111,100 amid elevated daily volumes of approximately $59.4 billion.

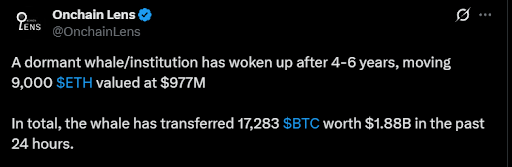

A series of high-value transactions by dormant holders has added fuel to the current rally. On-chain data reveals that a long-inactive wallet moved 17,283 BTC valued at roughly $1.88 billion within a single 24-hour window.

Source: OnchainLens

Last week, two Satoshi-era wallets transferred a combined 20,000 BTC for the first time in 14 years, stoking market speculation over long-term holder behavior.

Further inflows came from the Royal Government of Bhutan, which sent over 350 BTC (around $38.5 million) to Binance in the past 10 days. The transactions highlight the growing involvement of sovereign entities in Bitcoin’s capital flows and may suggest strategic liquidity operations or asset diversification.

Source: Arkham explorer

Technical Picture Signals More Upside: The Road to $150,000

Despite the sharp price appreciation, technical indicators suggest the rally still has legs. The Relative Strength Index (RSI) is currently at 63.62, a level that indicates strength without crossing into overbought territory. The MACD has printed a bullish crossover at 172.51, typically viewed as a buy signal, while the 10-day simple moving average remains above the 100-day—a classic indication of short-term momentum.

Still, some caution is warranted in the near term. The stochastic oscillator has risen to 86.46, a reading often associated with interim consolidation. Analysts flag resistance levels at $117,498 and $127,279 as potential inflection points. Failure to breach these levels decisively could trigger profit-taking.

Sentiment among institutional investors continues to improve, helped by accommodative macro conditions, steady ETF inflows, and concerns over traditional fiat debasement. Analysts at cryptona.co see $150,000 as a realistic price target for Bitcoin in the coming months provided that $117K is broken with volume support.

Key tailwinds include expectations of Federal Reserve rate cuts, further sovereign adoption, and rising demand for digital assets in inflation-hedging portfolios.

Bottom Line

Bitcoin’s breakout above $112,000 reflects both deepening institutional engagement and a pivotal shift in long-term holder behavior. While short-term corrections remain likely, technical and fundamental structures align toward further appreciation. The $150,000 target may no longer be speculative, as it’s increasingly becoming the market’s base case.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

WOM Protocol Launches Testnet of EVM Layer 1 Blockchain to Power the Next Era of SocialFi

Singapore, 11th July 2025, WOM Protocol was early to SocialFi. Back in 2020, when few believed in decentralized word-of-mouth marketing, WOM began building the infrastructure to make it real. While many “to-earn” models collapsed over time, WOM persisted – improving its protocol, growing its ecosystem and proving that authentic recommendations can scale. Today, WOM is taking its most significant step yet: launching the Testnet of its own EVM-compatible Layer 1 blockchain, unlocking a new phase of growth.

The Perfect Timing in a New SocialFi and InfoFi Landscape

In 2025, SocialFi and InfoFi have evolved rapidly, with projects like Kaito AI and Cookie DAO showcasing new models for decentralized content and community engagement. But in an age of AI-generated information, content validation and authenticity ratings are becoming inevitable. The reputation of creators – and the credibility of what they share – will be the most valuable assets in marketing.

This is why WOM’s timing is critical. While the protocol may have been ahead of the curve between 2020 and 2024, the team has demonstrated persistence, continuous improvement and has refined its unique content authentication model into a solution that can now be universally implemented across any type of content.

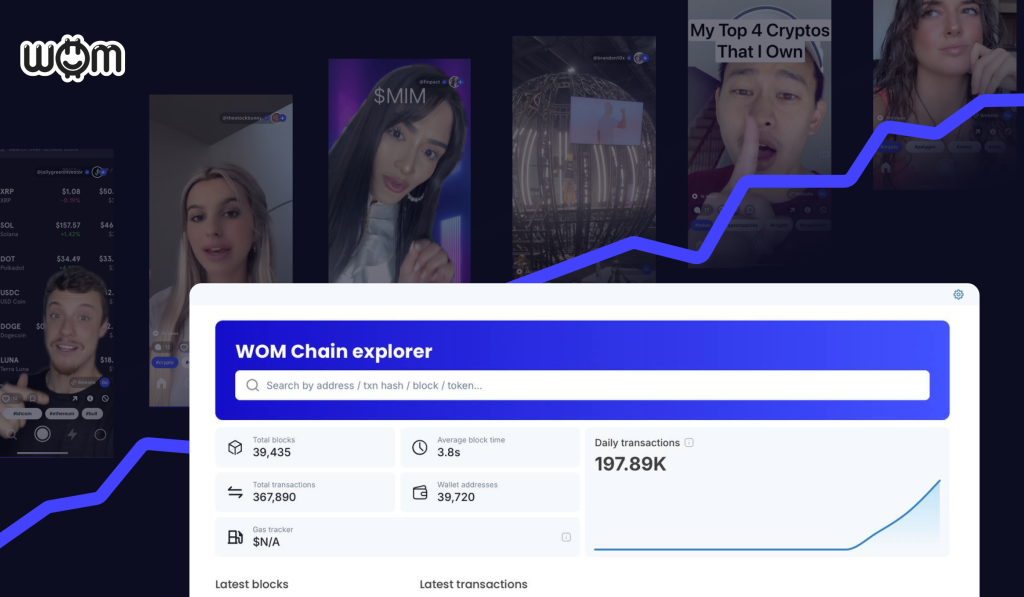

Since launch, WOM has surpassed 300,000 validated content pieces across platforms like the BULLZ app and the WOM Authenticator app and processes up to 200,000 daily transactions. These first applications will migrate their activity to the new WOM Layer 1 blockchain once Mainnet launches.

A $1 Million Grant Program and Strategic Growth Initiatives

To fuel ecosystem growth, WOM is introducing a grant pool worth up to $1 million in WOM Tokens over the next two years, supporting SocialFi builders, new platform integrations and community-led initiatives. This token unlock and a planned strategic token sale will help fund further development, onboard more projects and drive awareness through dedicated marketing and trading campaigns.

A High-Performance Blockchain Purpose-Built for SocialFi

The new WOM EVM Layer 1 blockchain is designed to meet the demands of decentralized applications, offering:

- Up to 10,000 transactions per second

- Transaction fees as low as $0.001

- Full EVM compatibility

- Smart contract automation to streamline rewards, validation, and governance

This combination enables a seamless experience for microtransactions, creator incentives and dynamic community engagement.

The Foundation for Authentic, Decentralized Communities

With the Testnet live, WOM will expand integrations, launch new SocialFi use cases and prepare for Mainnet launch in 2026.

In a landscape where SocialFi and InfoFi require dedicated infrastructure, WOM Protocol provides a high-performance home where communities can transact, collaborate and grow together. As the ecosystem evolves, WOM stands ready to be the foundation for authentic, decentralized economies built on trust and transparency.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Pichai Applauds Record-Breaking Success of THAIFEX – ANUGA ASIA 2025 Over 142,000 Visitors and Trade Value Surpassing 135 Billion Baht

-

Press Release1 week ago

Stallard Kane Exposes Real-Life Workplace Safety Fails to Raise Awareness Across UK Businesses

-

Press Release1 week ago

Solana Volume Bot Debuts New Solana Volume Booster for Instant Dexscreener Trending

-

Press Release6 days ago

Taps Pest Services Unveils Comprehensive Eco-Friendly Pest Control Solutions for Homes and Businesses in Lithia Florida

-

Press Release1 week ago

Nathan Smith: A Legacy of Leadership, Philanthropy, and Civic Duty in the Cayman Islands

-

Press Release6 days ago

Bangalore Cafe The Pure-Veg offering Kannada South Indian food in the Singapore

-

Press Release1 week ago

Real Estate Insider Unveils Q2 2025 Edition and Celebrates 2025 Award Winners

-

Press Release6 days ago

TR.ENERGY: Buy TRON Energy and Fee Savings on USDT Transfers in the TRX Network