Press Release

Harbour FX’s Advanced Risk Management Strategies: A Game-Changer for Investors

In today’s volatile financial markets, investors face an increasing number of risks that can impact their portfolios. From sudden economic shifts to unpredictable market fluctuations, managing these risks effectively has become a critical aspect of successful trading. As a leading trading platform, Harbour FX has developed an advanced suite of risk management tools designed to protect investors and optimize their trading strategies.

By combining innovative technology, AI-driven analytics, and institutional-grade security, Harbour FX is transforming the way traders approach risk, making it one of the most reliable platforms for both retail and institutional investors.

The Importance of Risk Management in Trading

Risk management is a fundamental component of successful investing. Without proper safeguards in place, traders are exposed to unnecessary financial losses that can quickly erode capital. Harbour FX understands the need for a structured approach to risk, offering a comprehensive range of tools that allow traders to mitigate exposure while maintaining profitability.

Effective risk management ensures that investors can:

- Protect their capital from significant losses.

- Maintain a balanced portfolio through diversification.

- Control leverage to prevent overexposure.

- Secure profits while limiting downside risks.

By integrating these principles into its trading framework, Harbour FX empowers traders with the confidence to navigate market uncertainties successfully.

Stop-Loss and Take-Profit Orders: Protecting Investments

A crucial feature of any professional trading strategy is the ability to set predefined exit points. Harbour FX provides traders with stop-loss and take-profit orders, allowing them to automate risk control without constant monitoring.

- Stop-Loss Orders – Automatically close a position when the price reaches a predetermined level, limiting potential losses.

- Take-Profit Orders – Secure profits by closing a trade once a target price is achieved, ensuring gains are locked in before the market reverses.

These tools help traders maintain disciplined risk management, preventing emotional decision-making that can lead to significant financial setbacks.

Negative Balance Protection: A Safety Net for Traders

One of the biggest concerns for leveraged traders is the possibility of a negative account balance. Market volatility can cause rapid price swings, leading to losses that exceed a trader’s initial deposit. To prevent this, Harbour FX offers negative balance protection, ensuring that clients never lose more than their available funds.

This safeguard is particularly valuable for new traders or those using high leverage, as it eliminates the risk of owing money beyond their initial investment. By implementing this policy, Harbour FX ensures that investors can trade with confidence, knowing their capital is protected from extreme market movements.

Hedging and Diversification: Minimizing Market Exposure

Diversification and hedging strategies are essential tools for reducing overall portfolio risk. Harbour FX provides access to multiple asset classes, allowing traders to spread their investments across different markets.

Available instruments include:

- Forex – Trade major and minor currency pairs with low spreads.

- Commodities – Hedge against inflation with gold, oil, and other commodities.

- Cryptocurrency – Gain exposure to digital assets while managing risk effectively.

- Equities and Indices – Invest in global stock markets with diversified options.

By offering a broad range of assets, Harbour FX enables traders to build diversified portfolios that can withstand market volatility and economic downturns.

AI-Driven Market Analysis: Predicting Risk in Real Time

Artificial intelligence is playing an increasingly important role in risk management. Harbour FX utilizes AI-powered algorithms to analyze market trends, identify potential risks, and generate predictive insights.

Traders can leverage AI-driven tools to:

- Detect early warning signals for market reversals.

- Identify correlations between different asset classes.

- Automate trading strategies based on real-time data.

By integrating AI technology, Harbour FX provides investors with a proactive approach to risk mitigation, allowing them to make informed decisions before market conditions change.

Leverage Control: Maximizing Gains While Reducing Risk

Leverage can be a powerful tool for increasing returns, but it also amplifies risk. Many traders fall into the trap of over-leveraging, which can lead to substantial losses. Harbour FX offers customizable leverage options, allowing traders to adjust their exposure based on their risk tolerance.

By giving investors the flexibility to control leverage ratios, Harbour FX ensures that traders can optimize their risk-reward balance while protecting their capital from excessive market exposure.

Advanced Order Execution and Liquidity Management

Fast and accurate order execution is crucial for minimizing slippage and avoiding unexpected losses. Harbour FX has developed an institutional-grade execution system that provides:

- Ultra-fast trade execution – Orders are processed in milliseconds to reduce slippage.

- Deep liquidity pools – Access to major liquidity providers ensures stable pricing.

- Minimal spreads – Competitive spreads reduce trading costs and enhance profitability.

By prioritizing execution speed and liquidity, Harbour FX ensures that traders can enter and exit positions seamlessly, without facing unnecessary risks due to price gaps or delayed order processing.

Market Sentiment Analysis: Staying Ahead of Investor Behavior

Understanding market sentiment is an essential aspect of risk management. Harbour FX provides traders with real-time sentiment indicators, giving them insights into how other investors are positioning their trades.

By analyzing sentiment trends, traders can:

- Identify potential market reversals.

- Avoid crowded trades that may lead to sudden price swings.

- Make informed decisions based on market consensus.

With access to sentiment analysis, Harbour FX equips traders with the ability to anticipate market movements and adjust their strategies accordingly.

Regulatory Compliance and Security Measures

Security and regulatory compliance play a critical role in mitigating operational risks. Harbour FX adheres to strict financial regulations, ensuring that all client transactions are transparent and secure.

The platform implements:

- High-level encryption – Protecting user data from cyber threats.

- Multi-factor authentication – Preventing unauthorized access.

- Secure fund segregation – Ensuring client funds are held separately from company finances.

By maintaining these security standards, Harbour FX provides traders with a safe and compliant environment to conduct their investment activities.

Why Harbour FX Stands Out in Risk Management

With an increasing number of trading platforms available, Harbour FX sets itself apart by prioritizing investor protection through advanced risk management solutions. From AI-driven insights to leverage control, stop-loss automation, and institutional-grade liquidity, the platform offers comprehensive safeguards that help traders navigate volatile markets with confidence.

By continually innovating and refining its risk management strategies, Harbour FX is leading the way in providing a secure, efficient, and intelligent trading environment for investors worldwide.

Media Contact

Organization: harbour fx

Contact Person: jeff lezer

Website: https://harbour-fx.com.au

Email: Send Email

Contact Number: +61280678303

Address: Three International Towers, Level 24 300 Barangaroo Avenue, 2000

City: Sydney

State: Sydney

Country: Australia

Release Id: 06032524756

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Trading in financial markets, including forex, commodities, cryptocurrencies, and equities, involves significant risks and may result in the loss of capital. Investors should conduct thorough research, assess their risk tolerance, and seek professional advice before making any trading decisions. Harbour FX does not guarantee profits or protection against losses, and past performance is not indicative of future results. Users should also ensure compliance with local regulations before engaging in trading activities.

The post Harbour FX’s Advanced Risk Management Strategies: A Game-Changer for Investors appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

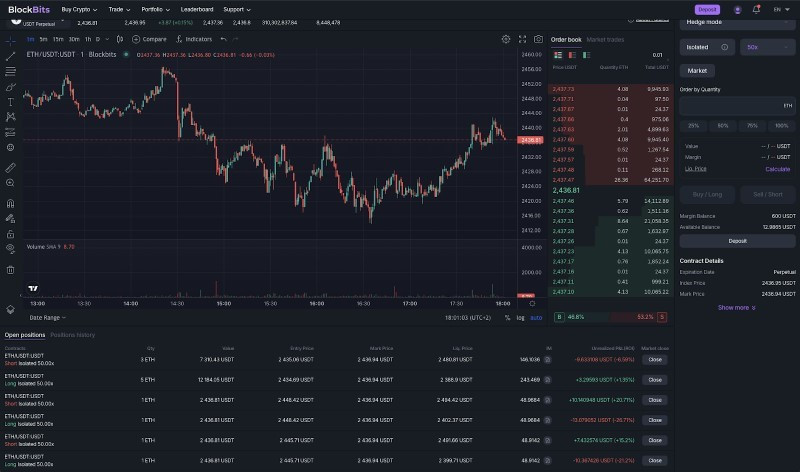

BlockBits Launches a Futures Trading Service, Offering Traders a Wide Range of Advanced Tools

Dubai, UAE – 14/07/2025 – (SeaPRwire) – BlockBits, crypto futures trading platform, launch a new tool for advanced futures trading for higher potential returns with up to 200x leverage.

As cryptocurrency markets mature and price swings become more extreme, active traders are increasingly turning to risk management strategies once reserved for traditional finance. One strategy gaining notable traction is hedging – protecting open positions by opening an opposing trade to balance potential losses.

Unlike in stocks or commodities, hedging in crypto has only recently become practical for a wider range of traders. With the expansion of futures and perpetual contracts, traders can now offset price movements without selling or transferring their core holdings – a key advantage for long-term investors facing short-term market uncertainty.

“For example, a trader holding a major crypto asset can hedge against sudden volatility by opening a short futures position. If the asset’s price drops, gains from the short can help offset losses on the original holding – providing greater peace of mind in unpredictable conditions”, – said in company.

Recognizing this growing need, several crypto exchanges are now integrating built-in hedging tools. Features such as the ability to hold both long and short positions on the same pair within a single account are making once-complex strategies more accessible. This is especially important for traders using high leverage or delta-neutral approaches, where profits and losses on opposite positions can balance each other out.

Such tools also reduce trading costs by avoiding the need to close and reopen positions repeatedly – a process that can rack up fees and slippage in fast-moving markets. A smoother, single-interface experience means traders can react faster to market shifts without interrupting their broader investment plans.

One platform at the forefront of this trend is BlockBits, which has designed its trading environment specifically with hedging in mind. Users can open long and short positions simultaneously on the same pair, track risk and margin separately, and monitor real-time profit/loss and liquidation levels across both sides. In a recent example with the ETH/USDT pair, BlockBits traders were able to hold dual up to 200× leverage positions – a feature not always offered by other exchanges.

By integrating hedging into the core trading interface, platforms like BlockBits are helping crypto derivatives mature – providing tools that cater to both aggressive trading and robust risk management. As more traders seek to balance exposure without sacrificing opportunity, such innovations are set to become a standard part of the crypto futures landscape.

Contact information

Brand: BlockBits

Contact: Media team

E-mail: info@blockbitstech.com

Website: https://blockbitstech.com/en

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Synthetic Darwin™ Self-Evolving AI System, with Already Secured Partnerships in Israel’s Aerospace & Defense Sectors, to Launch Utility Token on Solana July 15

Synthetic Darwin is launching its self-evolving AI utility token $DARWIN on Solana on July 15, backed by key defense partnerships in Israel and cutting-edge autonomous innovation.

is launching its self-evolving AI utility token $DARWIN on Solana on July 15, backed by key defense partnerships in Israel and cutting-edge autonomous innovation.

Delaware, USA – Darwin’s Lab, the flagship platform of Synthetic Darwin , will launch its utility token on Solana on Tuesday, July 15th, under the ticker $DARWIN. Trademark secured. Patent pending. With secured technical partnerships across Israel’s Aerospace & Defense sectors and a CAGE Code registration application in process to support future U.S. government and NATO procurement eligibility.

, will launch its utility token on Solana on Tuesday, July 15th, under the ticker $DARWIN. Trademark secured. Patent pending. With secured technical partnerships across Israel’s Aerospace & Defense sectors and a CAGE Code registration application in process to support future U.S. government and NATO procurement eligibility.

This utility token is designed to power innovation, incentivize research collaboration, and enable enterprise partners to access Synthetic Darwin’s self-evolving AI platform. The platform can be tasked to innovate and solve complex problems in the industry.

What Is Darwin’s Lab?

Darwin’s Lab represents a paradigm shift in AI development. Instead of training massive static models, Darwin creates a living digital ecosystem inspired by GA (genetic algorithms), where thousands of agents autonomously evolve, mutate, compete, and improve.

Powered by Synthetic Darwinism, this system applies evolutionary principles selection, crossover, and mutation to continuously generate and refine new generations of AI agents in real time. What once took years of human-led iteration can now happen in hours or days, with every cycle building on the last to drive ever-faster progress.

The result – A self-improving intelligence framework engineered to thrive in the toughest environments from unstable, adversarial networks to high-stakes defense simulations continuously adapting to solve problems conventional AI cannot.

Partnerships:

What sets Darwin apart isn’t just the technology, it’s the caliber of the partners.

Confirmed partnerships include:

- RIMON, a core supplier to Israel’s Iron Dome missile defense system, exploring how Darwin can enhance battlefield resilience through adaptive command interfaces and real-time optimization across connected defense assets.

- MOTOMEA, a pioneering testbed for self-evolving electric motors that autonomously run to failure, learn, and regenerate improved designs.

Together, these collaborations position Darwin at the forefront of aerospace and defense innovation and mission-critical resilience.

Additional partnerships across other high-impact industries are expected to be announced on a rolling basis in the coming weeks.

Trusted at the Highest Levels

- Trademark Secured: Synthetic Darwin

is a registered mark under UKIPO.

is a registered mark under UKIPO. - Patent Pending: Recursive Evolution of Intelligence system in motion.

- Accreditations & Compliance: Partner facilities are ISO 9001, AS9100C, and NATO STANAG certified. Several have active contracts with the Israeli Ministry of Defense.

Powering the Next Wave of Innovation

AI is hitting the limits of centralized, static models. Darwin offers a radically different path: a decentralized, self-evolving intelligence ecosystem that learns, adapts, and improves autonomously. Unlike traditional AI, it requires a fraction of the computing resources and human oversight to drive progress. This isn’t just a research concept—it’s in advanced development today, built in collaboration with some of the world’s leading defense and industrial partners.

Launch Details:

- Token: $DARWIN

- Chain: Solana

- Launch Date: Tuesday, July 15th, 2025

Join Synthetic Darwin Today:

Today:

- Website: https://darwinslab.ai/

- Twitter/X: https://x.com/darwinslab_ai

- Telegram: https://t.me/darwinslab

About Synthetic Darwin LLC

LLC

Synthetic Darwin LLC is a deeptech R&D company creating AI that evolves autonomously and continuously. Darwin’s Lab is an experimental platform for building secure, adaptive intelligence ready to tackle the world’s most demanding environments.

LLC is a deeptech R&D company creating AI that evolves autonomously and continuously. Darwin’s Lab is an experimental platform for building secure, adaptive intelligence ready to tackle the world’s most demanding environments.

$DARWIN serves as the utility layer for submitting tasks, securing compute allocation, and engaging with the recursive evolution of decentralized AI.

Website | Twitter (X) | Telegram

Press Contact:

DARWIN

Alex Taylor

Email: inquiry@darwinslab.ai

Website: https://darwinslab.ai/

Disclaimer:

The information provided in this release is not investment advice, financial advice, or trading advice. It is recommended that you practice due diligence (including consultation with a professional financial advisor) before investing or trading securities and cryptocurrency.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Achiever Magazine Honors MIT Professor Dr. Richard Larson as the Cover Feature of its 2025 Education Edition

Achiever Magazine is proud to announce that Dr. Richard Larson, esteemed Professor at the Massachusetts Institute of Technology (MIT), has been selected as the cover feature for its prestigious edition, “Top Leaders Making a Lasting Impact in Education, 2025.”

This special edition highlights visionary educators who are transforming learning through innovation, leadership, and an unwavering commitment to academic excellence. Dr. Larson’s feature explores his groundbreaking work in educational systems, his influence on technology-enhanced learning, and his continued efforts to bridge the gap between research and real-world educational challenges.

With a legacy spanning decades, Dr. Larson has earned global recognition for his contributions to operations research and his pivotal role in shaping modern educational frameworks. His cover story sheds light on his forward-thinking philosophy, dedication to mentorship, and the strategies he believes are key to preparing students for the future.

“It’s an honor to spotlight Dr. Richard Larson’s remarkable journey and impact,” said the editorial team at Achiever Magazine. “His work exemplifies the kind of leadership and innovation that is shaping the future of education worldwide.”

The Top Leaders in Education 2025 edition is now available digitally, with select print distribution to academic institutions and education industry leaders.

To read the full cover story and explore the profiles of Top Leaders Making a Lasting Impact in Education, 2025, visit: https://www.achiever-magazine.com/top-leaders-making-a-lasting-impact-in-education-2025-2/

To get your digital copy or learn more about the featured leaders, visit: https://www.achiever-magazine.com/business-magazines/

About Achiever Magazine

Achiever Magazine is a premier international publication dedicated to recognizing outstanding professionals across various sectors. With a commitment to featuring inspiring stories of leadership, innovation, and influence, the magazine serves as a platform for thought leaders shaping the world.

For Media Inquiries, Contact:

Achiever Magazine

16192 Coastal Hwy, Lewes, Delaware 19958, USA

Email: info@achiever-magazine.com

Phone: +13024040933

Website: www.achiever-magazine.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release2 days ago

AssetMint Launches Full-Stack Tokenization Infrastructure for Legally Compliant Real-World Assets

-

Press Release5 days ago

AnimalsSalecom Emerges as a Trusted Platform for Ethical Pet Companionship Connections

-

Press Release5 days ago

CodeGuru Accelerates Digital Transformation in the UAE with Cutting-Edge Web and Mobile App Solutions

-

Press Release6 days ago

Rewriting the Rules of Wealth- How Dr Mayowa Olusojis GO-PAS Blueprint Is Building a Financially Smarter World

-

Press Release6 days ago

WeTrade Earns Australian Financial Licence from ASIC

-

Press Release5 days ago

Michael Mitchell Named Certified Staffing Professional by the American Staffing Association

-

Press Release3 days ago

Launch of Ask Tenerife – The Ultimate Q&A Platform for Tenerife Enthusiasts

-

Press Release6 days ago

Author Launches RogueBooksnet to Publish AI Assisted Fiction Excluded by Traditional Publishers