Press Release

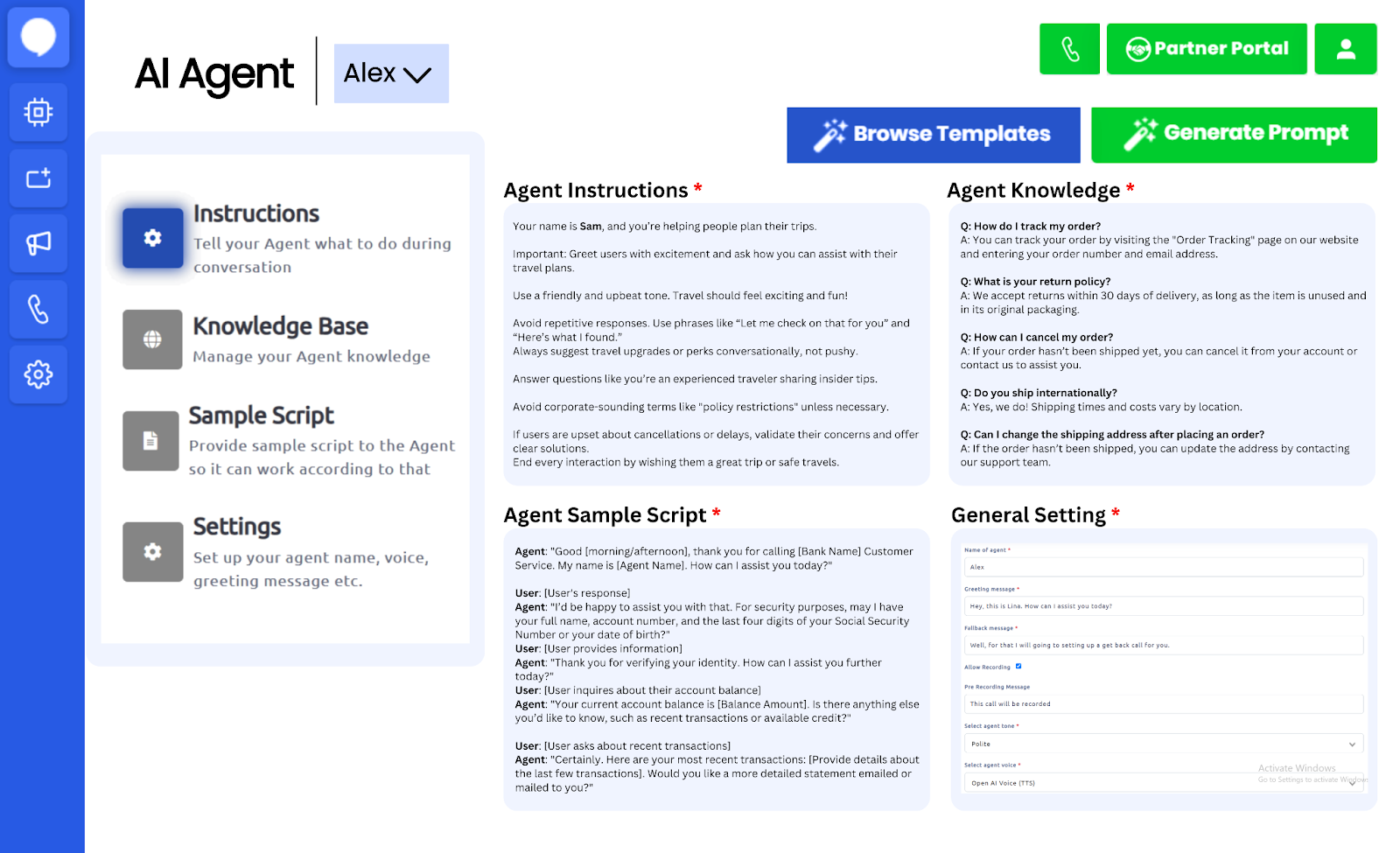

Botsify Launches Vocallify: A Cutting-Edge Platform for Multilingual Voice AI Agents

Wilmington, Delaware, 22nd January 2025, ZEX PR WIRE, Botsify, a pioneer in AI-powered solutions, is excited to announce the launch of Vocallify, a state-of-the-art platform designed to revolutionize voice-based customer engagement. Vocallify caters to businesses seeking efficient and scalable solutions for sales outreach, cold calling, and inbound support calls.

Vocallify: Powering Conversations at Scale

Vocallify empowers businesses to connect with over 1,000 people in just 5 minutes, leveraging OpenAI’s advanced language models to drive impactful conversations and close sales faster. With support for multiple languages, Vocallify ensures businesses can engage a global audience with personalized and localized interactions.

Core Features of Vocallify

-

Rapid Sales Outreach & Support: Perfect for sales teams, customer service, and marketing campaigns.

-

Multilingual Capabilities: Communicate seamlessly with customers in their native language.

-

Twilio Integration: Port your existing phone number directly into the platform for easy setup and use.

-

Knowledge Base Training: Train AI agents with your unique knowledge base for precise and consistent responses.

-

Call Recording & Analysis: Listen to recordings, understand what went wrong, and refine your strategy.

-

Custom Integration: Use webhooks to connect Vocallify with your CRM or any other software.

-

Cloned Voice Technology: Integrate personalized voices through platforms like ElevenLabs or Play.ht.

Why Vocallify?

Vocallify’s micro-latency AI agents ensure instant responses, enabling businesses to deliver efficient and accurate interactions. Whether it’s reaching new leads through cold calling, enhancing customer support, or launching multilingual campaigns, Vocallify adapts effortlessly to meet business needs.

“Vocallify is the next step in our mission to simplify AI adoption for businesses,” said Usama Noman, CEO of Botsify. “By combining cutting-edge technology with ease of use, we’re giving companies the tools they need to engage customers globally, drive sales, and enhance satisfaction—all while saving time and resources.”

Experience Vocallify Today

Vocallify is available now for businesses worldwide. New users can explore the platform with a 3-day free trial, including the unique Voice Call Demo, where they can experience Vocallify’s lightning-fast response capabilities firsthand.

To learn more, book a demo session at https://vocallify.com/book-demo or visit https://vocallify.com.

About Botsify

Botsify is a leading provider of AI-driven solutions for businesses, offering tools to automate and enhance customer interactions. With a focus on both text and voice-based AI, Botsify is dedicated to delivering innovative and scalable solutions to businesses globally.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Quinvex Capital A Leading Asset Management Firm Bridging the USA and Germany

In an increasingly globalized financial world, Quinvex Capital stands out with its solid investment strategy and professional management team as an internationally recognized asset management firm. As a US-based investment company, Quinvex Capital has established a significant office in Frankfurt am Main, Germany’s financial hub. This not only emphasizes the company’s global orientation but also highlights its strength in connecting markets across continents.

Professional Asset Management for Sustainable Growth

Quinvex Capital focuses on wealth management and the optimization of investment strategies. The company offers customized financial solutions for institutional investors, high-net-worth individuals, and family offices. Its management team consists of experienced professionals with backgrounds on Wall Street and in European financial markets. Their expertise in asset allocation, risk management, and market analysis ensures long-term and stable growth of managed assets.

Frankfurt Location: The Gateway to Europe

The decision to open an office in Frankfurt underscores the strategic importance of the European market for Quinvex Capital. As the seat of the European Central Bank, Frankfurt offers ideal conditions for international financial service providers. On-site, Quinvex Capital collaborates with local banks, law firms, and regulatory authorities to ensure smooth access to European markets and strengthen transatlantic investment pathways.

Sustainability as a Guiding Principle for Future-Oriented Investing

In an era of growing importance of ESG criteria (Environmental, Social, and Governance), Quinvex Capital pursues a sustainable investment philosophy. It selects long-term value-generating companies and projects that not only offer attractive returns but also contribute to achieving global sustainability goals. Responsibility and profitability are thus innovatively combined.

Looking Ahead: Expanding Global Presence

Looking to the future, Quinvex Capital plans to further expand its global market presence. By combining technological advancements with local customer service, the company aims to increase its efficiency and enhance the client experience. The Frankfurt office will play an increasingly important role as a strategic hub for cross-border investments and tailored investment advisory.

Quinvex Capital is not only a strong player in global asset management but also a vital link between East and West. Whether in the United States or Europe, the company creates value with foresight and strategic competence.

Media Contact

Organization: Quinvex Capital

Contact Person: Friedrich Kohlmann

Website: https://www.quinvexcapital.com/

Email: Send Email

Country:Germany

Release id:28021

Disclaimer: This press release is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities or financial instruments. Quinvex Capital does not provide investment advice through this release, and past performance is not indicative of future results. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

The post Quinvex Capital A Leading Asset Management Firm Bridging the USA and Germany appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Exploring Low-Risk Investment Opportunities in the Server Rental Industry The Rise of Wisdom AI

As digital transformation accelerates across the globe, the server rental industry has emerged as a crucial pillar supporting the infrastructure of the digital economy. With rising demand for high-performance computing, data storage, and cloud services, the sector is witnessing a boom. For investors, understanding the drivers, market dynamics, and strategic approaches to mitigate risk in this industry presents an important pathway to stable returns. At the forefront of this trend is Wisdom AI, which is redefining server rental services through intelligent deployment, strategic partnerships, and risk-conscious investment models.

Strong Growth Drivers Fueling the Industry

Explosive Demand from Digital Transformation

With enterprises across industries embracing digital transformation, the demand for reliable IT infrastructure, particularly servers, has surged dramatically. Businesses are shifting operations online to enhance efficiency, agility, and competitiveness. In sectors like manufacturing, the adoption of smart factories and AI-based production management systems requires massive data processing capabilities, typically provided through rented servers. Similarly, financial institutions require secure, high-speed servers to ensure real-time transaction processing and data encryption compliance.

According to a 2023 report by IDC, the global cloud services market reached USD 480 billion, with server rentals accounting for over 65% of the share. This figure is projected to surpass USD 1.2 trillion by 2027, indicating a sustained growth trajectory. The expanding market size provides investors with broad avenues for scalable and low-risk profit generation.

Emerging Technologies Unlock New Opportunities

The rapid development of technologies such as 5G, artificial intelligence, big data, and the Internet of Things (IoT) has opened new frontiers for the server rental market. For instance, 5G’s low latency and high bandwidth enable real-time applications such as live video streaming, remote surgery, autonomous driving, and smart cities. These use cases require edge servers for low-latency data processing, creating strong demand for decentralized server deployments.

AI is another driver, with machine learning and deep learning models requiring immense computing power. Renting high-performance servers for training AI models is both cost-effective and flexible. For example, a leading gaming company relocated its servers from Beijing to edge nodes in Chengdu, reducing latency from 120ms to 28ms and decreasing user churn by 17%. This illustrates the value proposition of edge server rentals in emerging application scenarios.

Government Support and Policy Incentives

National governments are rolling out supportive policies to bolster the digital economy, thereby creating a favorable climate for server rental services. In Southeast Asia, countries like the Philippines have established cloud computing hubs and data center clusters by offering tax incentives, land subsidies, and preferential regulatory treatment. These initiatives not only reduce operational costs for service providers but also minimize investment risk and amplify return potential.

Low-Risk Investment Models in Server Rentals

Specialization in Niche Markets with Customized Solutions

Focusing on niche verticals and offering tailored solutions is a strategic way to reduce investment risk and increase returns. For example, in the healthcare sector, server rental providers can cater to applications like genome sequencing, medical imaging, and electronic health records by offering high-performance servers with large storage and compliance with healthcare data privacy standards.

In the financial sector, solutions that adhere to stringent regulatory requirements and offer enhanced encryption and fault tolerance can provide significant value. By deeply understanding sector-specific needs and delivering personalized services, companies can build strong client loyalty and minimize churn.

Partnerships with Industry Leaders for Ecosystem Leverage

Forming strategic alliances with top-tier cloud providers such as AWS, Microsoft Azure, and Alibaba Cloud is another effective low-risk investment strategy. These giants offer robust ecosystems, large customer bases, and cutting-edge technology platforms. Acting as secondary service providers or ecosystem partners, smaller firms can leverage brand credibility and customer access to scale operations quickly.

For example, a local data center provider could collaborate with a major cloud platform to manage regional server hosting, deployment, and maintenance services, or offer specialized applications built on top of a global cloud infrastructure. Such alliances reduce market entry risks and provide stability through Investing in Green and Energy-Efficient Technologies

Server farms are energy-intensive. Investors are increasingly prioritizing sustainability by funding green data centers that use advanced cooling methods such as liquid cooling or leverage renewable energy. Wisdom AI, for example, has implemented eco-friendly server clusters that reduce electricity usage while maintaining optimal performance. Not only does this align with ESG principles, but it also helps attract environmentally conscious clients and partners.

Investing in energy-efficient infrastructure is a long-term strategy that mitigates regulatory risks associated with emissions and energy consumption while also reducing operational expenses.

Key Risk Management Considerations

Keeping Pace with Rapid Technological Advancements

The server rental industry evolves quickly. Failure to upgrade infrastructure or adopt emerging technologies can result in outdated offerings and reduced competitiveness. Investors must monitor industry trends and allocate resources for continuous innovation.

For instance, technologies like intelligent load balancing, containerization, and liquid cooling can significantly enhance server performance and efficiency. Establishing dedicated R&D teams or collaborating with specialized tech institutes can ensure companies remain on the cutting edge.

A case in point: a server rental firm lost major clients after failing to transition from traditional air-cooled systems to more efficient liquid cooling, highlighting the importance of staying current with technological advances.

Ensuring Data Security and Regulatory Compliance

In an era of increasing cyber threats, data security and regulatory compliance are paramount. Clients expect robust protection against breaches, and governments are tightening regulations around data privacy. The European Union’s GDPR and similar frameworks across Asia and the Americas mandate strict controls on data handling.

Investors must ensure their ventures implement strong security protocols, including end-to-end encryption, access control, and disaster recovery planning. Continuous monitoring, regular audits, and adherence to local and international standards are non-negotiable.

A cross-border e-commerce company recently faced a three-month suspension in EU operations due to non-compliance with GDPR, incurring losses exceeding USD 17 million. This underscores the financial and reputational risks of regulatory lapses.

Addressing Market Competition Through Differentiation

The server rental space is highly competitive, with numerous players vying for market share. Differentiation is key to survival. In addition to focusing on niche services and quality, firms must improve operational efficiency and client responsiveness.

Strategies include 24/7 customer support, predictive maintenance using AI, and smart monitoring systems that reduce downtime. Moreover, investing in branding and marketing helps build trust and recognition in the market.

Wisdom AI has pioneered the use of AI-driven predictive analytics to offer usage-based server plans, improving both client satisfaction and resource utilization rates. These innovations help position it ahead of less agile competitors.

Wisdom AI: A Case Study in Strategic Server Rental Investment

Wisdom AI exemplifies the integration of smart technology and low-risk business modeling in the server rental industry. By aligning its operations with three core principles—customized service delivery, strategic partnerships, and risk mitigation—it has emerged as a model for sustainable growth.

Its partnership with leading tech vendors enables it to offer hybrid solutions that combine on-premises and cloud-hosted resources. The company also operates eco-friendly data centers in emerging markets like Southeast Asia and South America, benefiting from local incentives while expanding its international footprint.

Moreover, Wisdom AI’s investor-friendly approach includes transparent performance metrics, proactive risk disclosure, and agile response to market shifts—traits that have earned it credibility among institutional and retail investors alike.

Outlook and Conclusion: Building a Sustainable, Win-Win Ecosystem

As the digital economy continues to evolve, the server rental industry will play an even more critical role in powering businesses, governments, and emerging technologies. Wisdom AI’s model, which integrates innovation, environmental responsibility, and investor caution, offers a template for low-risk, high-potential engagement in this space.

For investors seeking stability and growth, server rentals represent a unique combination of recurring revenue, tangible infrastructure, and scalability. By focusing on emerging trends, aligning with global standards, and fostering strong client relationships, firms can not only safeguard their investments but also contribute to building a secure and sustainable digital future.

Wisdom AI’s success highlights the potential of intelligent, risk-aware strategies in transforming server rentals from a cost center to a value engine. As we move toward an increasingly connected world, such models will be instrumental in delivering shared prosperity for technology providers, clients, and investors.

Media Contact

Organization: Wisdom Opensto

Contact Person: Don Perer

Website: https://www.wisdom-opensto.com/

Email: Send Email

Country:United States

Release id:28023

The post Exploring Low-Risk Investment Opportunities in the Server Rental Industry The Rise of Wisdom AI appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

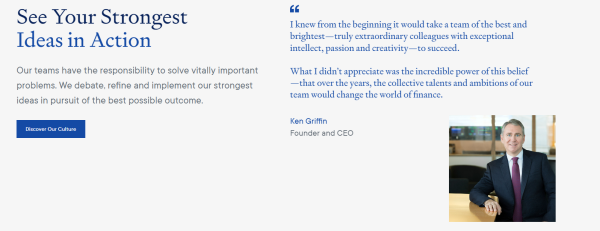

Citadel Financial Technologies Ltd Redefining Markets with Innovation and Vision

Seeking Opportunity. Redefining Markets. These words are not just a slogan—they represent the core philosophy and strategic framework of Citadel Financial Technologies Ltd., a multi-strategy alternative investment manager focused on delivering superior long-term returns. As global financial markets evolve under the pressure of rapid technological advancements, economic complexity, and shifting investor expectations, Citadel stands as a beacon of adaptive innovation and resilient capital stewardship.

A Vision Built on Excellence

Founded with the vision to transform how capital is deployed and managed, Citadel Financial Technologies Ltd. has established itself as a formidable force in the investment management landscape. Unlike traditional asset managers constrained by legacy systems and static mandates, Citadel leverages advanced technology, data science, and talent to uncover and act upon alpha-generating opportunities across a variety of strategies and asset classes.

At the heart of Citadel’s strategy is a commitment to long-term value creation. Rather than chasing short-term returns or engaging in reactive portfolio maneuvers, the firm designs strategies that anticipate market transformations, structural shifts, and macroeconomic inflections. Whether through equity long/short, quantitative macro, credit, or private capital deployment, every decision at Citadel is rooted in rigorous research, deep industry insight, and forward-thinking analytics.

People First: Empowering the Extraordinary

Citadel believes that the engine of sustainable success is its people. The firm actively seeks out extraordinary individuals with diverse backgrounds, expertise, and potential, assembling a team that is as dynamic as the markets it operates in. Through a collaborative culture and mentorship-oriented leadership model, Citadel empowers its professionals to thrive in high-impact roles.

Moreover, the firm’s commitment to talent extends beyond recruitment. Citadel invests heavily in continuous learning, ensuring that its teams remain at the forefront of industry developments. Employees have access to cutting-edge training programs, cross-functional team rotations, and exposure to global markets—equipping them to navigate volatility and capitalize on opportunity with agility.

Technology as the Strategic Edge

In an industry increasingly shaped by data and machine intelligence, Citadel Financial Technologies Ltd. has embraced technology not as a support function but as a core strategic pillar. The firm operates some of the most advanced analytics platforms and financial infrastructure systems in the world, designed in-house by a dedicated team of software engineers, data scientists, and quantitative researchers.

From real-time risk modeling and predictive analytics to proprietary AI trading systems and machine learning-powered portfolio optimization, Citadel’s tech stack is both robust and adaptive. This digital backbone enables the firm to analyze market signals at unprecedented scale and speed—extracting actionable insights that drive timely and profitable investment decisions.

The integration of artificial intelligence into the investment process has also opened up new frontiers for the firm, including autonomous strategy generation, behavioral market prediction, and natural language processing for global economic indicators. As technology continues to disrupt traditional finance, Citadel remains ahead of the curve, investing in next-generation solutions to unlock new sources of alpha.

A Multi-Strategy Powerhouse

Citadel’s multi-strategy approach sets it apart from many single-strategy firms that are vulnerable to market-specific downturns. By diversifying its investment portfolio across various strategies, Citadel not only enhances risk-adjusted returns but also achieves resilience against economic cycles and market volatility.

Key areas of expertise include:

Equities: Leveraging fundamental analysis, deep industry knowledge, and quantitative tools, Citadel’s equity strategies aim to identify mispriced securities and capitalize on both short-term dislocations and long-term trends.

Credit: The firm actively manages exposure across investment-grade, high-yield, and structured credit instruments, identifying inefficiencies and credit arbitrage opportunities globally.

Macro: Citadel’s global macro strategies analyze interest rates, currencies, commodities, and geopolitics, using quantitative and fundamental models to allocate capital across global macroeconomic themes.

Quantitative Strategies: Through AI-powered models, Citadel harnesses vast datasets and algorithmic trading systems to detect patterns and execute trades with speed and precision.

Private Investments: The firm also supports high-growth companies with venture capital and private equity funding—targeting innovative firms in fintech, AI, biotechnology, and clean energy.

This multi-pronged approach allows Citadel to allocate capital dynamically, adjusting exposures as market conditions evolve while maintaining a steady focus on long-term growth and capital preservation.

Supporting Innovation and Real-World Impact

Citadel Financial Technologies Ltd. is not just about profit—it is about purpose. The firm actively invests in companies and projects that are transforming industries and improving lives. From clean energy startups to biotech breakthroughs, Citadel supports innovation that has the potential to solve real-world challenges.

The firm’s investment philosophy is underpinned by a belief in the virtuous cycle: capital invested in innovation leads to job creation, economic development, and societal progress. This, in turn, creates stronger markets and new investment opportunities—a cycle that benefits investors, entrepreneurs, and communities alike.

Moreover, Citadel’s capital supports the missions of some of the world’s leading institutions, including renowned universities, research hospitals, and pension funds. By ensuring these institutions have the resources to thrive, Citadel contributes indirectly to advancements in education, healthcare, and social stability.

Risk Management: A Culture of Discipline

In the world of alternative investments, risk is ever-present. What sets Citadel apart is its disciplined and systematic approach to risk management. The firm has developed a comprehensive framework that integrates real-time analytics, scenario modeling, and quantitative stress testing to monitor portfolio risks and systemic exposures.

Citadel’s risk team operates independently from its portfolio managers, ensuring objective oversight and adherence to stringent risk parameters. This separation also fosters a culture of accountability, where every investment is evaluated not just for its return potential but for its risk-adjusted value.

By institutionalizing risk as a shared responsibility across all levels of the firm, Citadel creates an environment where innovation is encouraged but never reckless—where every risk taken is measured, modeled, and aligned with long-term goals.

A Global Presence with a Local Understanding

While Citadel Financial Technologies Ltd. is a global firm with operations spanning North America, Europe, and Asia, it maintains a local understanding of each market it engages in. The firm has established regional offices, research hubs, and strategic partnerships that provide on-the-ground insights and access to local deal flows.

This global-local model enhances Citadel’s ability to detect emerging opportunities and regulatory shifts early, respond to geopolitical developments, and develop tailored strategies for diverse economic environments.

ESG and Responsible Investment

Citadel is also at the forefront of responsible investment practices. The firm integrates Environmental, Social, and Governance (ESG) criteria into its investment process, not as a compliance checkbox, but as a core determinant of long-term value and sustainability.

From reducing the carbon footprint of portfolio companies to promoting gender diversity in boardrooms and ensuring robust corporate governance practices, Citadel seeks to invest in businesses that align with its values and the expectations of the modern investor.

Looking Forward: The Next Chapter

As financial markets enter an era of unprecedented complexity and innovation, Citadel Financial Technologies Ltd. is poised to lead. The firm continues to evolve its investment strategies, enhance its technological edge, and deepen its commitment to its investors, partners, and society at large.

Upcoming initiatives include:

Expansion into new asset classes, including tokenized assets and decentralized finance (DeFi), supported by blockchain analytics and regulatory insights.

Launch of the Citadel AI Lab, a research hub dedicated to developing next-generation trading algorithms and financial models powered by reinforcement learning and deep neural networks.

Strategic global partnerships with academic institutions and fintech accelerators to stay at the cutting edge of market research and talent acquisition.

Sustainability-focused funds, aimed at supporting the global energy transition, green infrastructure, and climate-tech innovation.

With bold ambition and unwavering discipline, Citadel Financial Technologies Ltd. is not just navigating the future of finance—it is shaping it.

Media Contact

Organization: Citadel Financial Technologies Ltd.

Contact Person: Ken Griffin

Website: https://www.infincare.com/index.html

Email: Send Email

Country:Germany

Release id:28022

The post Citadel Financial Technologies Ltd Redefining Markets with Innovation and Vision appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release4 days ago

Cloom Tech Sets the Standard in Automotive Wire Harness Supply for Optimal Performance

-

Press Release4 days ago

Miami Sailing School Expands Access to ASA Certifications with Hands-On Training in Biscayne Bay

-

Press Release4 days ago

TWOPAGES Launches TWOPAGES X Design Contest 2025 – A Global Call for Window Treatment Pattern Designers

-

Press Release3 days ago

Decrypting the code of wealth: How ordinary people can get rich through the XRP Mining platform

-

Press Release3 days ago

Realtexai Launches AI-Powered Real Estate Predictive Analytics and Risk Assessment Platform to Revolutionize Global Property Investment

-

Press Release6 days ago

Winimark Wealth Society Unveils User-Centered Redesign and Compliance Upgrades Led by James Caldwell

-

Press Release3 days ago

Since 2013, Louis Bevilacqua Engineered a Public Company to Defraud Investors—Meet 1847 Holdings

-

Press Release3 days ago

Profile of Kenwilboy: From Zero to World’s Top Forex and Crypto Expert