Press Release

How Eagle Crest Asset Management is Shaping the Future of Investment

Driving Financial Innovation: How Eagle Crest Asset Management is Shaping the Future of Investment

United States, 20th Jan 2025 – Founded in 2019 by Ridel Bosco Castillo and a group of visionary partners, Eagle Crest Asset Management has emerged as a leader in professional asset management and financial innovation. With its headquarters anchored in the dynamic and evolving landscape of emerging markets, the firm has set itself apart through a relentless focus on enhancing investment efficiency, managing risks, and leveraging cutting-edge technologies like big data, artificial intelligence (AI), and blockchain. Eagle Crest Asset Management’s mission is clear: to provide clients with advanced tools and comprehensive solutions that empower them to navigate the complexities of modern investment landscapes with confidence.

A Visionary Foundation for Success

The inception of Eagle Crest Asset Management is rooted in the collective expertise and forward-thinking approach of its founder, Ridel Bosco Castillo, and his partners. With years of experience in finance and investment, Castillo envisioned an asset management firm that would prioritize innovation, education, and customer service. This foundational ethos has guided the company’s journey from its early days to its current status as a trusted name in the global financial community.

Under Castillo’s leadership, Eagle Crest has built a reputation for its ability to adapt to the rapidly changing financial environment. The firm’s success lies in its commitment to continuous improvement and a client-centric approach. By fostering transparency, trust, and excellence, Eagle Crest ensures that its clients—whether individual investors, institutions, or corporations—are equipped with the tools they need to achieve their financial goals.

Leveraging Technology for Smarter Investments

Eagle Crest Asset Management stands at the forefront of technological innovation in the finance industry. The firm’s strategic use of big data and AI has transformed the way investment decisions are made, offering a level of precision and insight that was previously unimaginable. By analyzing vast amounts of data from diverse sources, Eagle Crest identifies patterns, trends, and opportunities that traditional methods often overlook. This data-driven approach enables the firm to construct optimized investment strategies that align with clients’ specific objectives.

One of the cornerstones of Eagle Crest’s technological arsenal is the proprietary Eagle Eye Advanced Quantitative Investment System. This state-of-the-art platform integrates big data analytics, machine learning algorithms, and real-time market monitoring to deliver actionable insights. The system is designed to assist clients in making informed decisions by providing detailed analyses of market conditions, asset performance, and risk factors. Whether evaluating stocks, bonds, or cryptocurrencies, Eagle Eye empowers investors with the information they need to stay ahead in a competitive market.

Blockchain technology is another area where Eagle Crest has made significant strides. By utilizing blockchain’s secure and transparent features, the firm enhances the efficiency and reliability of its operations. This technology not only streamlines transaction processes but also provides clients with an additional layer of security and accountability, reinforcing the firm’s commitment to excellence.

Comprehensive Investment Services for Diverse Needs

Eagle Crest Asset Management’s suite of investment services is as diverse as the clients it serves. The firm offers tailored solutions across a wide range of sectors, including stocks, funds, foreign exchange, bonds, options, gold, and cryptocurrency. This broad spectrum ensures that clients can access the right instruments to achieve their financial objectives, regardless of their risk tolerance or market preferences.

For clients seeking long-term growth, Eagle Crest provides expert guidance in equity investments, helping them build diversified portfolios that capitalize on market opportunities. The firm’s fund management services are equally robust, offering access to professionally managed funds that deliver consistent returns. In the realm of foreign exchange, Eagle Crest’s advanced tools and analytics enable clients to navigate the complexities of currency trading with confidence.

In addition to traditional investment avenues, Eagle Crest has established itself as a leader in emerging sectors like gold and cryptocurrency. Recognizing the growing importance of these assets, the firm provides specialized insights and strategies to help clients harness their potential. By staying ahead of industry trends, Eagle Crest ensures that its clients are well-positioned to capitalize on new opportunities.

Strategic Risk Management for Stability and Growth

In the volatile world of finance, effective risk management is essential. Eagle Crest Asset Management has developed a comprehensive approach to mitigating risks while maximizing returns. The firm’s use of AI and advanced analytics plays a pivotal role in this process, enabling it to identify potential risks and implement proactive measures to address them.

Eagle Crest’s risk management strategies are rooted in a deep understanding of market dynamics and client objectives. By conducting thorough assessments of market conditions, geopolitical factors, and economic trends, the firm ensures that its investment decisions are informed and balanced. This methodical approach minimizes exposure to unforeseen events and enhances portfolio resilience.

The Eagle Eye Advanced Quantitative Investment System further strengthens the firm’s risk management capabilities. By continuously monitoring market data and simulating various scenarios, the system provides real-time insights into potential vulnerabilities. This allows Eagle Crest to adjust its strategies swiftly and effectively, safeguarding its clients’ investments in an ever-changing financial environment.

A Focus on Emerging Markets

Eagle Crest Asset Management’s emphasis on emerging markets is a key differentiator that sets it apart from its competitors. These markets, characterized by rapid economic growth and untapped potential, present unique opportunities for investors. Eagle Crest’s expertise in navigating these dynamic environments has enabled it to deliver exceptional value to its clients.

By leveraging its deep understanding of local markets and regulatory frameworks, Eagle Crest identifies high-growth opportunities that align with clients’ goals. The firm’s commitment to research and innovation ensures that it remains ahead of industry trends, enabling it to uncover opportunities that others may overlook. This focus on emerging markets not only diversifies clients’ portfolios but also contributes to sustainable economic development in these regions.

Standing Out in the Finance Industry

Eagle Crest Asset Management’s unique approach to asset management has earned it a prominent position in the finance industry. The firm’s integration of technology, innovation, and client-centric practices creates a value proposition that is difficult to replicate. By prioritizing transparency, education, and ethical practices, Eagle Crest has built a strong foundation of trust and loyalty among its clients.

One of the firm’s standout features is its dedication to financial education. Eagle Crest believes that informed clients make better investment decisions, and it actively works to enhance financial literacy through workshops, seminars, and educational resources. This commitment to empowerment extends beyond individual clients, fostering a more knowledgeable and confident investment community.

A Bright Future Ahead

As Eagle Crest Asset Management continues to grow and evolve, its commitment to innovation and excellence remains unwavering. The firm’s ability to adapt to changing market conditions and embrace new technologies positions it for sustained success in an increasingly competitive landscape. With its strong foundation, visionary leadership, and client-focused approach, Eagle Crest is poised to shape the future of asset management and redefine what it means to be a trusted partner in the world of finance.

In conclusion, Eagle Crest Asset Management’s journey from its founding in 2019 to its current status as a leader in financial innovation is a testament to its dedication, expertise, and forward-thinking strategies. By leveraging big data, AI, and blockchain, the firm empowers clients to achieve their financial goals with confidence and precision. With its diverse range of services, robust risk management practices, and focus on emerging markets, Eagle Crest is not just keeping pace with industry trends—it is setting them.

Media Contact

Organization: Eagle Crest Asset Management

Contact Person: Ridel Bosco Castillo

Website: https://ecamai.com/

Email: Send Email

Address: 4470 Doctors Drive Los Angeles CA 90017

Country: United States

Release Id: 20012522754

The post How Eagle Crest Asset Management is Shaping the Future of Investment appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Central Europe’s Tech Hubs Announce Record Growth in Global Investment Interest

DUBAI, UAE – June, 2025 – Central Europe’s technology hubs have officially announced record-breaking growth in 2025, attracting €6.3 billion in tech-related investments during the first half of the year. This surge highlights the region’s rising global influence and growing appeal among venture capital firms, strategic corporate investors, and innovation-driven governments.

Once considered peripheral in the global tech ecosystem, the region—particularly Poland, Czech Republic, Hungary, and Slovakia—has now emerged as a dominant force in technology, cybersecurity, and financial innovation. According to data from regional analytics firms and private equity monitors, the €6.3 billion figure marks a 47% year-over-year increase, setting a new benchmark for Central European tech.

Global Entrepreneur Roman Ziemian, who has actively invested in and supported numerous startups across Central Europe, said this shift is long overdue.

“We’re seeing the results of years of quiet building. The talent has always been here. What’s changed is that global investors are finally looking beyond traditional tech capitals,” said Ziemian. “Central Europe is no longer catching up — it’s leading. It’s where some of the most future-forward thinking in AI, cybersecurity, and FinTech is happening right now.”

From Outsourcing to Originating Innovation

Historically, cities like Kraków, Brno, and Budapest were known as cost-effective outsourcing destinations for Western firms. Today, these cities are producing their own global players—homegrown startups that are creating deep tech products, attracting top talent, and solving complex global challenges.

“We’re moving from being back-office partners to front-line innovators,” said Ziemian. “Startups here aren’t just building software—they’re shaping the digital future of finance, healthcare, infrastructure, and national security.”

According to Ziemian, this evolution is driven by a mix of powerful trends: the availability of highly skilled STEM graduates, the rise of regional accelerators, and a favorable business environment that includes tax incentives, EU grants, and cross-border startup programs.

Cybersecurity and FinTech Lead the Charge

Among the sectors drawing the most attention in Central Europe are cybersecurity and financial technology, both of which are tightly aligned with regional expertise in mathematics, cryptography, and regulatory innovation.

“We are building technology that is both commercially scalable and socially responsible,” Ziemian said. “There’s a strong focus here on ethical innovation—creating tech that respects privacy, security, and regulatory frameworks.”

Government and Ecosystem Support Fuel Momentum

The success of Central Europe’s tech scene is not just due to private capital. Governments across the region have taken strategic steps to support innovation, from streamlining startup visas to launching public-private innovation funds. In Poland, a national tech sandbox initiative allows startups to test financial products in a controlled regulatory environment. In Slovakia, tax breaks for R&D activities are driving record investment in AI and robotics.

Ziemian notes that collaboration between public institutions and the private sector is key to sustaining growth.

“This isn’t about quick wins,” he explained. “We’re building ecosystems that can compete globally—not just in 2025, but for the next 25 years. That means continued collaboration across education, government, and business.”

A New European Tech Corridor

With this surge in momentum, industry observers are starting to refer to Central Europe as “Europe’s Silicon Corridor”—a distributed network of cities with shared ambition and complementary strengths.

Ziemian believes this model offers a more sustainable and inclusive future than the traditional single-city dominance model.

“We don’t need one mega-city. We need many strong, connected hubs working together,” he said. “Warsaw, Brno, Budapest—they each bring something unique to the table. That’s the future of innovation: decentralized, diverse, and collaborative.”

Looking Ahead

As the second half of 2025 unfolds, projections suggest the region could exceed €12 billion in annual tech investment for the first time. Ziemian remains bullish on Central Europe’s trajectory.

“We’re just getting started,” he said. “This is a region where ideas become action, and ambition meets execution. The world is beginning to notice—and it’s only going to grow from here.”

Contact:

Roman Ziemian

roman@romanziemianmobility.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

GET OSHA Courses Now Offering Authorized OSHA 30 Certification Across the US

Dallas, TX – As workplace safety regulations tighten and demand for certified professionals surges, Get OSHA Courses is stepping up with an innovative, user-friendly platform offering OSHA 30 online and other OSHA training online, transforming how American workers and companies approach safety.

With a mission to simplify access to OSHA certification online, Get OSHA Courses delivers fast, 100% online OSHA 30-Hour Training that meets OSHA guidelines, fits into busy schedules, and doesn’t break the bank. From construction workers to warehouse staff and safety officers, the platform is designed for everyone looking to advance their safety knowledge and meet legal compliance requirements, anytime, anywhere.

A Smarter Way to Get OSHA 30 Certified

OSHA 30 is an essential certification for workers and supervisors of high-hazard professions. This incorporates construction, general industry as well as warehousing. It’s part of the 30-hour OSHA Outreach Training Program. In many states, it’s required by law for various jobs. It’s often a must for job eligibility, too.

Get OSHA Courses stands out in a crowded market by offering:

- Excellent OSHA 30 Online training course material.

- Instant access with self-paced modules.

- Mobile-friendly platform for on-the-go learning.

- Printable OSHA Safety Certification upon completion.

- Official OSHA DOL Plastic Card.

- Round-the-clock customer support.

- Group discounts for businesses & bulk training orders

This efficient process helps workers finish their OSHA 30 Certification quickly. Companies can train teams without interrupting their operations.

Meeting a Growing Need Across the U.S

As industries grow after COVID, safety remains a top concern. The U.S. Department of Labor is doing a lot to sensitize people on the dangers at work. Due to the increased pressure, the demand of quality OSHA 30-Hour Training programs has increased tremendously.

In response, we scaled rapidly to meet nationwide needs, helping thousands of professionals get certified and stay legally compliant, from New York City skyscraper crews to manufacturing hubs in Texas and beyond.

Trusted by Workers. Respected by Employers.

Backed by industry-recognized partners and aligned with OSHA guidelines, we ensure that certifications should be legitimate and also respected by employers across all 50 states. Whether it’s for individuals looking to advance their careers or businesses seeking to quickly certify their teams, the platform’s flexibility and compliance-first approach make it a reliable partner.

An Invitation to Train Smarter, Not Harder

With an ever-evolving regulatory landscape, OSHA 30 training online is not only mandatory; it’s essential. We are not just offering another online class; it’s providing a reliable, affordable pathway to workplace safety, job advancement, and peace of mind.

Those seeking OSHA 30 Online or other OSHA safety certification options can sign up today and begin training immediately. Businesses interested in group enrollments can contact the team directly for custom solutions.

About Get OSHA Courses

Get OSHA Courses is an online safety training platform dedicated to delivering fast, affordable, and accessible OSHA certification online. With a focus on OSHA 30-Hour Training, the company serves thousands of workers and businesses nationwide, helping them stay compliant, job-ready, and safe on the job.

Media Contact

Organization: Get OSHA Courses

Contact Person: Shawn Malik

Website: https://getoshacourses.com

Email: Send Email

Contact Number: +12185035891

Country:United States

Release id:29111

The post GET OSHA Courses Now Offering Authorized OSHA 30 Certification Across the US appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AetherSwift ($AESH): Redefining Web3 Utility with Real-World Forex, Gaming, and Staking Integration — Presale Round 1 Now Live

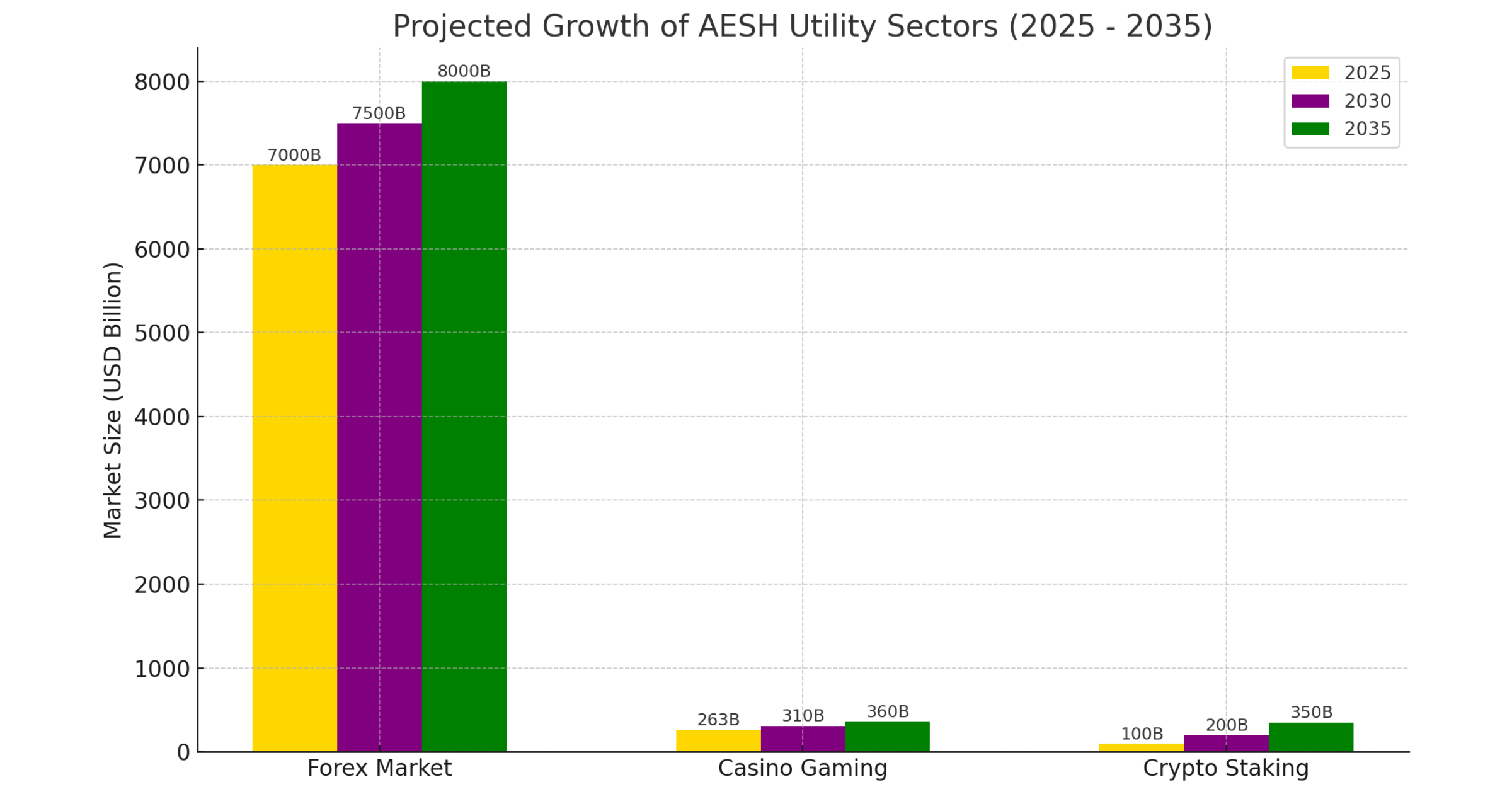

The much-anticipated Web3 utility project, AetherSwift ($AESH), has officially announced the launch of its Presale Round 1, opening the doors for early supporters and community members to participate in its multi-utility blockchain ecosystem. Combining the immense potential of Forex trading, decentralized casino gaming, and crypto staking, AetherSwift is set to bridge real-world financial markets with the exciting opportunities of the decentralized Web3 landscape.

In an era where most tokens struggle to offer genuine value and functionality, AetherSwift ($AESH) stands apart by delivering practical use cases beyond speculation. The project’s vision is clear — to empower users with tools that integrate seamlessly into the multi-trillion-dollar Forex market, offer transparent and provably fair on-chain casino experiences, and provide sustainable staking opportunities with high APYs.

What is AetherSwift ($AESH)?

AetherSwift is not just another token in the crowded crypto space. It is a Web3 utility token that offers holders real value through three core pillars:

-

Forex Integration

Users can engage directly in the global Forex market — an industry moving over $7 trillion daily — using AESH tokens. This allows AetherSwift to become one of the few blockchain projects offering a genuine bridge between DeFi and traditional financial markets. -

Decentralized Casino Platform

Built on transparent, fair smart contracts, AetherSwift’s on-chain casino offers classic and modern gaming options. Every transaction and game result is verifiable on the blockchain, ensuring provable fairness for gamers worldwide. -

Staking with Passive Rewards

AESH holders can participate in crypto staking, earning passive income with flexible lock-in periods and attractive annual percentage yields (APYs). This feature makes AetherSwift an appealing option for long-term DeFi enthusiasts.

AESH Tokenomics: Designed for Growth and Stability

AetherSwift’s tokenomics are crafted to support long-term sustainability and value creation. The total supply of AESH tokens is 500 million, distributed strategically across various ecosystem stakeholders:

-

25% for Investors

-

25% allocated to the Community to fuel growth and engagement

-

15% for the Development and Technology Reserve

-

15% GAMING and Forex Incentive

-

10% for Marketing & Partnerships

-

10% allocated to Team & Advisors

With deflationary mechanisms and a fixed supply on the BEP-20 network, AESH promises to deliver scarcity-driven value as the project scales.

Presale Round 1 Details — Your Early Advantage

The AetherSwift Presale Round 1 is now live, offering AESH tokens at an exclusive entry price of $0.012 per token. Following the initial round, the next price will rise to $0.015, giving early participants a clear advantage before listing.

Presale participants will benefit from:

-

Priority access to staking pools

-

Eligibility for referral rewards and bonus airdrops

-

Higher potential ROI post-listing

With projections suggesting up to 3X ROI after exchange listing, the AetherSwift presale is already attracting attention from retail and institutional investors alike.

Real-World Impact of Blockchain Transparency

AetherSwift’s integration of Forex trading and decentralized casino gaming sets a new benchmark in real-world blockchain applications. By blending traditional finance (Forex) with provably fair GameFi and high-yield DeFi staking, AESH offers unmatched utility — something rarely seen in the 2025 Web3 token space.

Governed by a DAO model, the project invites community-driven decision-making, ensuring transparency, decentralization, and user empowerment at every stage.

Join the AetherSwift Revolution

The Web3 world is evolving, and AetherSwift is positioned to lead the way with practical utility and community focus. Whether you are a Forex trader, a GameFi enthusiast, or a DeFi investor, AetherSwift opens the door to new opportunities in one cohesive ecosystem.

Presale Round 1 is now live at: www.aetherswift.com/presale

About AetherSwift

AetherSwift ($AESH) is a next-generation Web3 project offering real-world utility through Forex trading, decentralized gaming, and staking opportunities. Built on the secure and scalable BEP-20 blockchain, AetherSwift aims to redefine the role of tokens in the digital economy by integrating revenue-generating use cases with community-driven governance.

Media Contact:

Twitter: https://x.com/AetherSwift

Join the AetherSwift Telegram Community: https://t.me/aetherswiftcommunity

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release4 days ago

Dallas Agency Breaks Industry Norms with Risk-Free Reputation Management Trial for Small Businesses

-

Press Release3 days ago

Coinsult Sets the Standard in Smart Contract Audits With Proven Track Record and Introduces New Dashboard

-

Press Release5 days ago

Querv Exchange Upgrades Web Platform with Multilingual and Intelligent Navigation

-

Press Release1 week ago

Dr Yahia Ananes Metabolic Protocol Offers New Integrative Strategy for Chronic Illness and Cancer Support

-

Press Release1 week ago

Driven by RWA and AI, NPC leads the new era of crypto finance

-

Press Release4 days ago

Royal Saints Launches Bold New Streetwear Brand Where Urban Edge Meets Regal Style

-

Press Release4 days ago

Dallas Agency Breaks Industry Norms with Risk-Free Reputation Management Trial for Small Businesses

-

Press Release3 days ago

Investors Abandons Cloud’s Mining as Lithium LLC Dominates Passive Crypto Income Space